Royal London Asset Management Property and Graftongate acquire 52 acres of prime West Midlands industrial & logistics development site

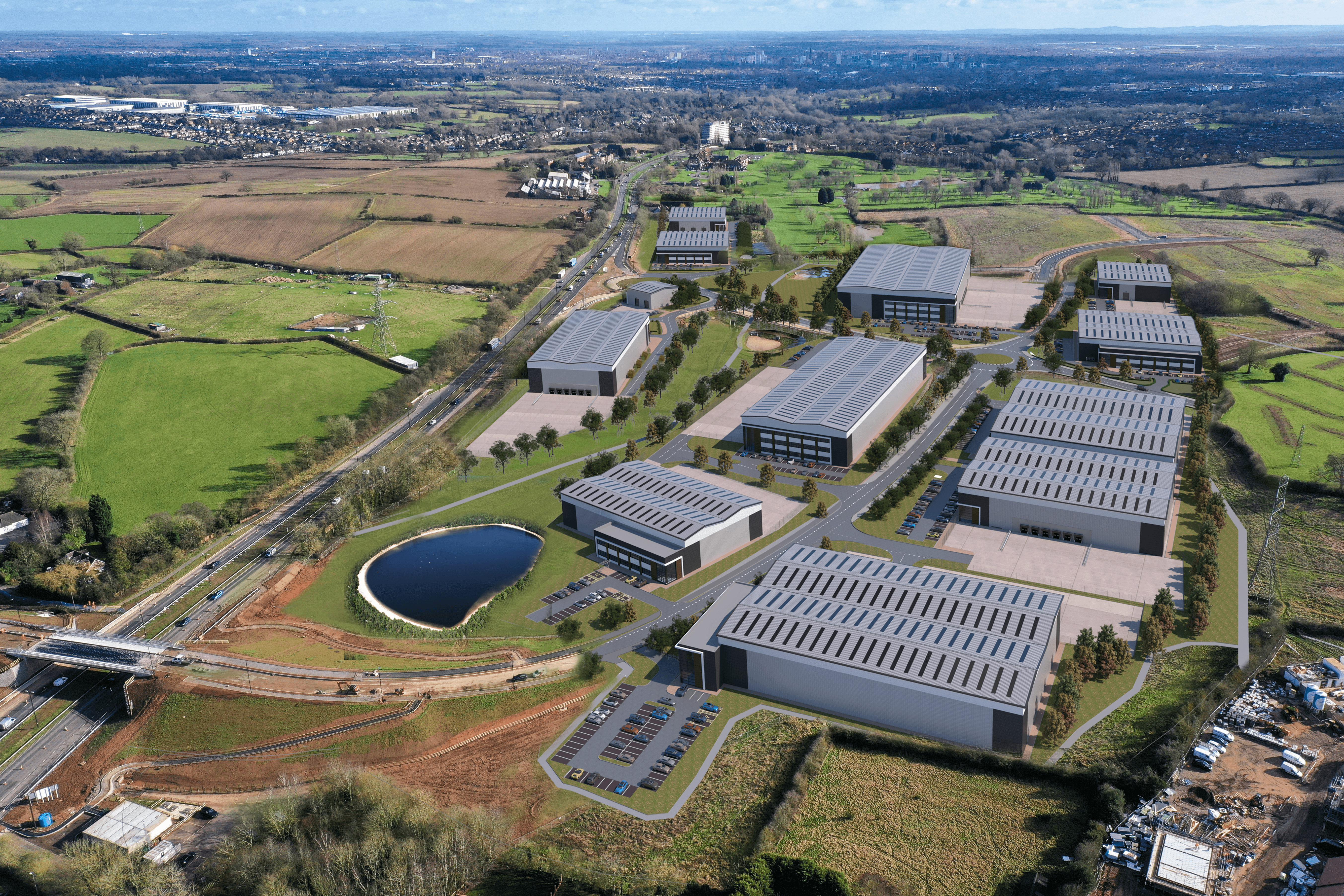

Royal London Asset Management Property, in partnership with industrial and logistics developer, Graftongate, has acquired 52 acres of land for development at Pickford Gate, Coventry, from Hallam Land, the land promotion and planning business of Henry Boot.

The site has outline planning consent for circa 645,000 sq ft of new employment space, comprising industrial and logistics, manufacturing and research and development facilities.

A planning application for Pickford Gate was originally submitted by Hallam Land in 2018, which secured outline planning consent in 2021 for the 52-acre employment land parcel, as well as 2,400 homes, of which at least 25% are proposed for affordable housing, a primary school, district and local centres, green open spaces, community facilities and playing fields.

The wider scheme includes the delivery of a new road junction which connects it directly to the A45 dual carriageway, providing access to Coventry, Birmingham and other key arterial roads. Hallam Land secured funding through the Homes England Housing Infrastructure Fund process to deliver the junction, which was completed successfully in April 2024.

Royal London Asset Management Property manages over 18 million sq ft of industrial and logistics across the UK, with the majority of sites located across the South and South East.

Newton LDP, Hollis Hockley LLP and Shoosmiths LLP advised Hallam Land and the landowners on the sale. Pinsent Masons and BNP Paribas advised Royal London Asset Management Property.

James Orr, Head of Industrial & Logistics at Royal London Asset Management Property, said:

“This acquisition aligns with our strategy to repurpose capital and enhance portfolio value. Together with our Development Manager, Graftongate, we are committed to creating best-in-class facilities for industrial and logistics occupiers, prioritising high-quality environments with advanced ESG standards.

“Our proposed scheme at Pickford Gate offers an exceptional opportunity, thanks to its prime location and strategic road connections, to bring much-needed multi-let mid-box space to a market currently dominated by large-scale logistics. We anticipate strong interest, particularly in this under-served regional sector.”

Tim Roberts, CEO at Henry Boot, commented: “This latest deal at Pickford Gate marks another successful outcome on behalf of both our shareholders and the landowners we have partnered with on the project. Pickford Gate will have a huge impact, transforming the local area, delivering much-needed homes and employment opportunities. We look forward to seeing the next phases of the development come to life.”